Hyperliquid Supported and Restricted Countries

.webp)

.webp)

Summary: Hyperliquid restricts access for users in the United States, Ontario, and sanctioned regions like Russia, North Korea, Iran, Cuba, and Syria.

Outside these restricted jurisdictions, Hyperliquid operates in over 180 countries without requiring KYC, providing decentralized perpetual and spot trading through its custom-built, HyperEVM layer 1 blockchain.

Hyperliquid is accessible in over 180 countries and requires no KYC for trading, but restricts access in the United States, Ontario, and other sanctioned jurisdictions based on its Terms of Use.

The UK, Singapore, Hong Kong, France, Australia & more

United States, Ontario (Canada), Iran, North Korea, Syria, Cuba

No KYC, 3x-40x leverage, fee rebates, staking tiers

What Countries Does Hyperliquid Restrict?

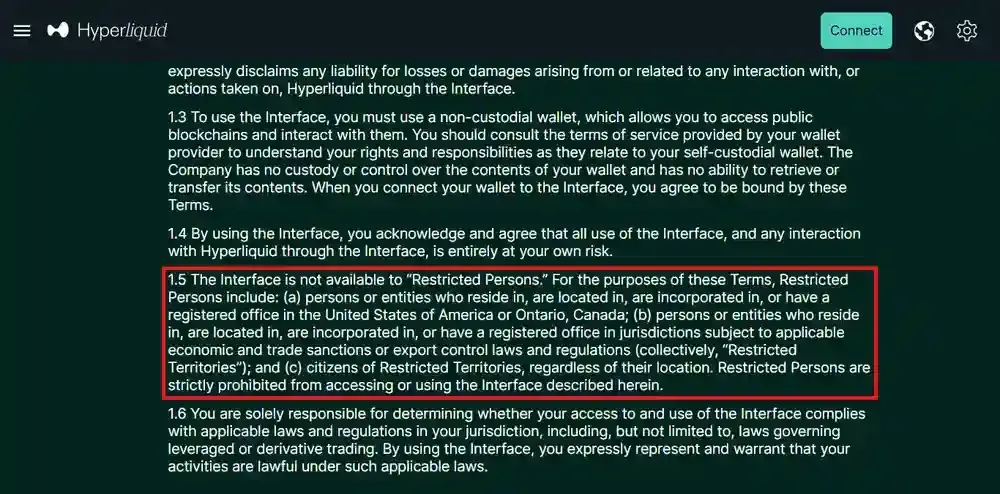

As of the latest update to Hyperliquid's Terms of Use, users from specific jurisdictions are prohibited from accessing the Hyperliquid interface. Access is restricted based on geographic location, incorporation, residency, or citizenship status, especially in relation to U.S. regulations and global sanctions.

The following countries and regions are explicitly restricted from using Hyperliquid's app:

- United States: Includes all U.S. states and territories; both individuals and entities are barred regardless of citizenship or physical presence.

- Ontario, Canada: Access is prohibited for users residing in or operating out of Ontario, whether individuals or incorporated entities.

- Sanctioned Territories: Jurisdictions subject to economic sanctions or export control laws not named in the Terms, typically including Russia, North Korea, Iran, Cuba, and Syria.

These typically align with jurisdictions identified by bodies such as the U.S. OFAC Sanctions List or EU restrictive measures, which are updated regularly.

Hyperliquid Supported Countries

Hyperliquid is accessible in over 180 countries, making it one of the most globally inclusive decentralized perpetual exchanges. With a user base exceeding 400,000 traders, the protocol offers wide accessibility for users seeking alternatives to centralized exchanges, which often impose strict KYC or regional limitations.

Users across supported jurisdictions can trade 100+ assets, including major cryptocurrencies and trending tokens. New listings are influenced by community demand, and Hyperliquid plans to advance toward a fully decentralized, permissionless asset listing process, offering flexibility without gatekeeping.

According to Similarweb, the platform receives 3.6 million monthly visits, with top traffic coming from the United States (17.32%), United Kingdom (10.25%), Singapore (6.68%), Hong Kong (5.88%), and France (5.22%).

Is Hyperliquid Available in the US?

No, Hyperliquid is not available to users in the United States, as explicitly stated in its Terms of Use, which prohibit access to the interface by any person or entity located, residing, or incorporated in the U.S. This restriction applies to both trading on the platform and directly using the official front-end.

While Hyperliquid's native token, HYPE, can be purchased on decentralized exchanges, U.S. users may face limitations depending on wallet compatibility and regional access restrictions.

Some community members report using non-custodial wallets and VPNs to interact with Hyperliquid or to buy HYPE, but doing so might carry legal risk in the future.

Does Hyperliquid Require KYC?

No, Hyperliquid does not require Know Your Customer (KYC) for regular users trading through its decentralized interface. As a permissionless DeFi protocol, users connect via crypto wallets and retain full control over their funds without undergoing identity verification.

However, KYC (or a Know Your Business) is required for those looking to participate as validators through the Hyper Foundation Delegation Program. Applicants must hold at least 10,000 HYPE, maintain high-uptime infrastructure, and comply with jurisdictional restrictions to be eligible.

Hyperliquid HYPE Airdrop Eligibility Geo-Restrictions

Hyperliquid’s HYPE airdrop included geo-restrictions that excluded users from regions like the United States, Ontario, and other sanctioned jurisdictions. Users in these areas might've seen an in-app message stating they were ineligible based on location.

While a Season 2 airdrop has not been confirmed, many users are remaining active on the platform in anticipation. Best practices include maintaining clean wallet histories, interacting consistently with Hyperliquid features, and ensuring activity comes from supported regions.

Was Hyperliquid Hacked?

Hyperliquid was not hacked, but it did suffer a major financial exploit in March 2025 involving the illiquid token JELLY. The attacker manipulated the token's market using $12 million across multiple accounts to trigger a sequence of liquidations for profit.

Two accounts opened large long positions while a third account opened a short; the attacker then artificially pumped JELLY’s price by 400%, causing the short to be liquidated. This loss was absorbed by Hyperliquid’s liquidity provider vault (HLP), allowing the attacker to exit with millions in profit.

Although no smart contract or protocol vulnerability was exploited, the exploit exposed weaknesses in the liquidation system tied to low-liquidity assets. Hyperliquid delisted JELLY shortly after and confirmed that affected users would be reimbursed by the Hyper Foundation.

About Hyperliquid

Hyperliquid is a decentralized exchange engineered for fully onchain, low-latency trading with deep liquidity and no reliance on centralized infrastructure. Its custom Layer 1 enables natively integrated order books, one-block finality, and throughput capable of supporting over 200,000 orders per second.

The exchange features onchain perpetual futures and spot markets, with every trade, order, and liquidation processed transparently. HyperCore powers the trading layer, while the HyperEVM brings smart contract support for builders to create onchain financial applications.

Hyperliquid offers a volume-based fee model with staking discounts, maker rebates, and community-directed rewards through the HLP and assistance fund. Advanced order types like TWAP, stop-limit, and scale orders are executed directly onchain, with risk managed by mechanisms like auto-deleveraging.

Final Thoughts

Hyperliquid’s approach to geographic access is clear: if you're in a restricted jurisdiction like the U.S. or Ontario, the interface won’t let you in. These regional blocks are enforced at the interface level to align with legal and compliance standards.

For users in supported countries, the exchange offers fast, KYC-free trading across a growing list of onchain assets. As access policies and global regulations shift, eligible users should stay informed to ensure uninterrupted use.

Frequently Asked Questions

Can I use Hyperliquid without completing KYC verification?

Yes, Hyperliquid allows users to trade without completing any KYC process, as long as they are in a supported jurisdiction. Access is permissionless and wallet-based, but geo-blocking is enforced through the interface.

How does Hyperliquid enforce geo-restrictions?

Geo-restrictions are enforced at the front-end level, meaning users from restricted regions like the U.S. or Ontario are blocked from accessing the platform’s interface. These restrictions align with Hyperliquid's Terms of Use and international compliance frameworks.

What happens if I try to access Hyperliquid from a restricted country?

Users from blocked regions will see an in-app message preventing access and will be unable to interact with the exchange through the official interface. Attempting to bypass this using VPNs may violate the Terms of Use and carry legal or account-related risks.

Does Hyperliquid hold any official licenses for its operations?

Hyperliquid operates as a decentralized exchange without explicit mention of holding specific regulatory licenses in its public documentation.

Users should be aware that operating in a decentralized manner doesn't exempt the platform from adhering to international laws and regulations.