6 Best Crypto Exchanges in South Korea

.webp)

Summary: South Korea has developed one of the most advanced cryptocurrency markets in Asia, supported by strong retail participation. Regulators have introduced comprehensive rules under the Financial Services Commission (FSC), requiring crypto exchanges to comply with AML standards.

Here are the leading crypto investment platforms supporting South Korean won (KRW) deposits:

KuCoin is the best crypto exchange in Korea as it provides free KRW deposits, low fees, a wide range of cryptocurrencies, unique features and the platform can be used in Korean.

Available Markets

1,000+ Cryptocurrencies

Trading Fees

0.1% Spot Trading Fee

KRW Deposit Methods

Bank Transfers, Cards, Kakao Pay

Top Crypto Trading Platforms in South Korea

South Korea’s digital asset industry operates under a framework overseen by the Financial Services Commission (FSC). The exchanges that rank among the best are those that support KRW deposit options, offer transparent fee structures, and maintain strong security practices. Below, we highlight some of the top platforms in Korea, comparing their core features and advantages.

1. KuCoin - Best Crypto Exchange in South Korea

KuCoin is the best crypto exchange for South Korean traders who want scale, liquidity, and access to one of the broadest altcoin selections worldwide. Founded in 2017, it now serves 40 million investors across 200+ countries and maintains an average 24-hour trading volume above $5.4 billion.

Its platform supports over 1,000 coins, making it a leader for traders who want exposure to new assets, often listed through GemSPACE or the Launch Hub. On the product side, KuCoin offers spot, margin, and futures markets, plus useful tools like leveraged tokens, trading bots, staking, and crypto loans.

Security is central to KuCoin’s appeal, with Proof of Reserves audits guaranteeing 1:1 backing of user assets. Protection features include device management, biometric login, and withdrawal passwords. The exchange also supports 20+ languages, including Korean, and provides 24/7 local customer support.

Platform Highlights:

- Fees: Spot fees start at 0.1%, with reductions for KCS token holders and VIP levels.

- Supported Assets: 1,000+ cryptocurrencies.

- Regulation & Licensing: Globally licensed, accessible for Korean users.

- KRW Deposit Methods: Credit cards, debit cards, bank transfers, Google Pay, and P2P markets like GmoneyTrans.

2. MEXC - Trade Derivatives with 500x Leverage

MEXC has built a reputation among Korean traders for its deep liquidity, aggressive leverage options, and low-cost fee model. Founded in 2018, the exchange has quickly scaled to a global footprint, serving tens of millions of users and regularly processing multi-billion dollar daily volumes.

Its standout feature is the ability to trade futures with leverage up to 500x, making it a magnet for high-frequency and professional derivatives traders. The platform lists more than 2,600 spot pairs and nearly 1,500 derivatives contracts, providing one of the broadest markets in the industry.

Alongside spot and futures trading, it also offers leveraged ETFs, copy trading, demo accounts for practice, and a P2P marketplace for fiat conversions. Its “Kickstarter” and “Launchpool” programs reward users with free token distributions and staking yields, sometimes climbing into triple-digit APRs.

Platform Highlights:

- Fees: Spot maker 0%, taker 0.05%, and MX token gives further discounts..

- Supported Assets: 2,600+ spot pairs, 1,400+ futures contracts.

- Regulation & Licensing: Globally registered, accessible to South Korean traders.

- KRW Deposit Methods: Credit cards, debit cards, bank transfers, and Kakao Pay.

3. Upbit - Leading Korean Crypto Exchange

Upbit is based in Gangnam-gu and is the most liquid cryptocurrency exchange in South Korea, operated by Dunamu Inc. since 2017. The platform is fully licensed under Korea’s FSC and registered as a Virtual Asset Service Provider (VASP), making it one of the most trusted venues for local investors.

The exchange specializes in KRW spot trading, listing more than 180 digital assets paired directly with the Korean won. Investors benefit from institutional-grade APIs, a clean and intuitive interface, and advanced charting powered by the Upbit Composite Index (UBCI) and Altcoin Index.

Additional services include staking options, reward events, and integration with Kakao’s digital ecosystem. Security is central to Upbit’s operations. The platform deploys multi-factor authentication, cold wallet storage, and a Fraud Detection System (FDS) that actively monitors unusual trading patterns.

Platform Highlights:

- Fees: Flat 0.25% per trade.

- Supported Assets: 180+ cryptocurrencies.

- Regulation & Licensing: FSC-licensed VASP (Registration No. 2021-01), fully compliant with Korean law.

- KRW Deposit Methods: Direct bank transfers, K-Bank, and KakaoPay.

.webp)

4. Bithumb - Exciting Membership Program

Bithumb is one of South Korea’s oldest and most recognized cryptocurrency exchanges, having operated since 2014. What makes it distinctive is its membership program, which provides tiered benefits like trading fee discounts, cashback opportunities, and exclusive promotions for active traders.

The platform supports a wide range of digital assets across KRW, BTC, and USDT markets, offering hundreds of trading pairs. Beyond traditional trading, Bithumb also provides lending services (through “Lending Plus”), staking products, and periodic airdrop events that boost engagement.

From a compliance standpoint, Bithumb is fully licensed under the FSC as a registered VASP. The exchange operates with real-name verification through KB Kookmin Bank. Customer service is available 24/7 via phone, chatbot, and KakaoTalk, which is a major draw for Korean investors.

Platform Highlights:

- Fees: Base trading fee of 0.25%, with discounts for membership tiers.

- Supported Assets: 200+ cryptocurrencies.

- Regulation & Licensing: FSC-licensed, registered VASP in Korea.

- KRW Deposit Methods: Utilizes a KB Kookmin Bank escrow service mechanism. Users deposit KRW into the escrow account, which is then converted to “KRW points” in Bithumb and reflected in the user’s wallet after 30 to 45 minutes.

.webp)

5. Coinone - Offers KRW Lending & Borrowing

Coinone has been part of Korea’s exchange landscape since 2014 and is known for bringing new services into the market while staying fully compliant with local rules. Based in Seoul’s Yeouido financial district, Coinone provides access to KRW spot trading across 100+ cryptocurrencies.

What sets Coinone apart from its rivals is its KRW loan service, which lets investors use their digital assets as collateral to access liquidity without selling. The exchange also supports staking for ETH, SOL, ADA, and other proof-of-stake assets, giving investors a way to earn yield.

Security and customer support are central to Coinone’s operations. The platform stores the majority of customer funds in cold wallets and applies strict multi-factor authentication. Investors also have access to an online help center 24/7, as well as offline branches in Seoul for in-person support.

Platform Highlights:

- Fees: 0.2% trading fee, reduced for high-volume accounts.

- Supported Assets: 100+ cryptocurrencies.

- Regulation & Licensing: FSC-licensed, ISO/IEC certified, uses BitGo custody.

- KRW Deposit Methods: Real-name accounts via KakaoBank integration.

.webp)

6. Coincatch - Access Copy Trading Services

Coincatch is a next-generation trading platform with a strong focus on derivatives and copy trading with 200+ perpetual contracts. Its Derivatives Trading System 3.0 delivers ultra-low latency performance capable of processing millions of orders per second, supported by Nasdaq-class liquidity.

For investors, this means access to advanced tools like cross-margin, trailing stops, and demo accounts to practice strategies before committing capital. It also runs an active Rewards Center, with a newbie bonus up to 5,125 USDT, referral incentives, and affiliate commissions that settle daily.

The platform goes beyond standard trading by offering a dedicated Copy Trading marketplace, where users can automatically mirror the positions of experienced traders. This feature is backed by transparent performance dashboards, enabling followers to review returns before allocating capital.

Platform Highlights:

- Fees: Spot maker 0%, taker 0.1%.

- Supported Assets: 500+ cryptocurrencies.

- Regulation & Licensing: Registered MSB with FinCEN (US) and FINTRAC (Canada).

- KRW Deposit Methods: Credit cards, debit cards.

Is Crypto Regulated in South Korea?

South Korea’s regulatory stance toward cryptocurrency has evolved into one of the most structured in Asia. With the Act on the Protection of Virtual Asset Users (VAUPA) coming fully into effect on July 19, 2024, the state now legally binds virtual asset service providers (VASPs) to submit to rigorous oversight by the Financial Services Commission (FSC).

Under VAUPA, VASPs must segregate user assets from their own, store at least 80% of customer liabilities in cold wallets, secure insurance or establish reserves against hacks or system failures, retain transactional data for fifteen years, and report suspicious or irregular trades.

From September 2025, crypto and blockchain firms will be eligible for venture company status, unlocking access to tax breaks, research grants, and financing support. The Minister of SMEs and Startups, Han Seong-sok, has emphasized that this policy change aims to channel more venture capital into digital assets while fostering a transparent and responsible ecosystem.

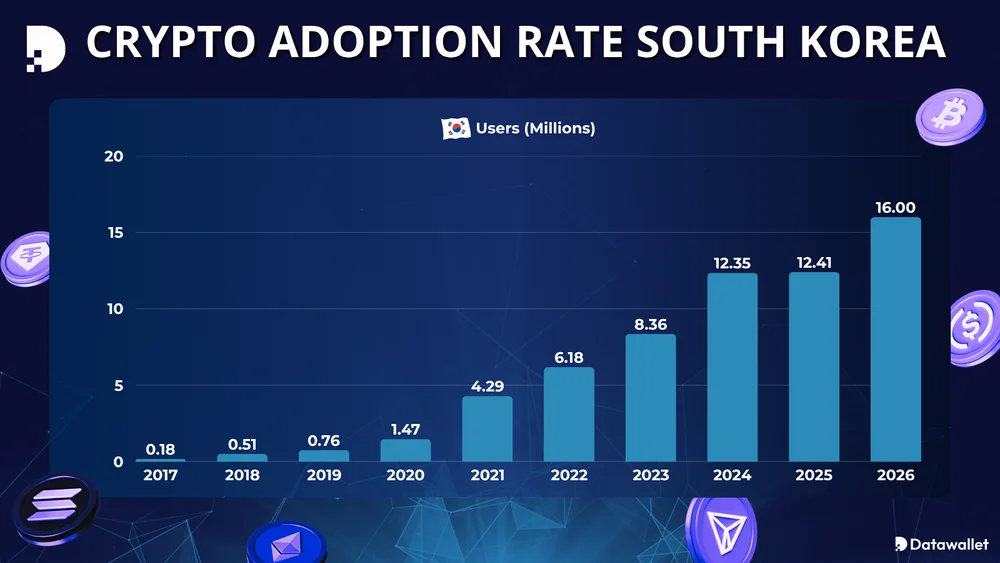

With more than 16 million Koreans now using crypto exchanges and revenue projected to surpass $1.1 billion in 2025, the country’s regulatory framework is evolving toward both tighter oversight of cross-border flows and greater integration of blockchain into its innovation economy.

How is Crypto Taxed in South Korea?

In South Korea, cryptocurrency taxation remains in flux, marked by repeated delays and significant policy debate. Although initial plans called for a 20% tax on crypto-asset profits (plus local levies) for gains above ~ 2.5 million KRW per year, that regime has been postponed to 2027 while lawmakers refine the rules.

Here’s a quick summary of the taxes currently applied to cryptocurrency in Korea:

- Corporate Tax – Companies holding or trading crypto as part of business operations are taxed under the corporate tax system, with rates ranging from 10% to 25%.

- Inheritance and Gift Tax – Digital assets transferred as gifts or inheritances are subject to taxation at rates up to 50%, similar to other property or financial assets.

The National Tax Service will collaborate with exchanges and financial regulators to develop reporting systems and compliance infrastructure in preparation for rollout. Until then, investors must track transactions meticulously, stay alert for legislative updates, and plan tax strategies conservatively in South Korea’s evolving environment.

Cryptocurrency Adoption in South Korea

South Korea has built one of the world’s most advanced digital asset markets, shaped by strict oversight, high retail participation, and a rapidly expanding exchange ecosystem.

According to Statista Market Insights, the cryptocurrency sector in Korea is projected to generate over US$1.1 billion in revenue in 2025, with annual growth expected to push this figure closer to US$1.3 billion by 2026.

The country already counts more than 16 million active crypto users, representing over 30% of the population, giving it one of the highest penetration rates globally.

How to Buy Bitcoin in Korea

Buying Bitcoin in South Korea is straightforward thanks to the country’s clear financial guidelines. Licensed local platforms dominate the market, and all transactions must be linked to verified bank accounts under the government’s real-name system. Here’s a step-by-step guide to getting started with BTC in Korea:

- Select a Crypto Exchange: Choose a licensed domestic exchange such as Upbit, Bithumb, or Coinone, or use a global platform that complies with Korea’s financial requirements and supports KRW deposits.

- Create Your Account: Open an account and complete Know Your Customer (KYC) checks. You’ll need to verify your identity with official documents such as a Korean ID card, passport, or bank-issued certificate, along with proof of residency if required.

- Deposit Funds: Add money to your account using a linked bank account under the real-name verification system. The most common funding method in Korea is a direct KRW transfer, ensuring transparency and compliance with anti-money laundering laws.

- Purchase Bitcoin (BTC): Once your account is funded, head to the Bitcoin trading section, enter the amount you wish to purchase, review the order details, and confirm the transaction.

By following these steps, investors in Korea can securely purchase Bitcoin through regulated exchanges while staying aligned with the country’s strict financial standards and investor protection measures.

Final Thoughts

South Korea’s cryptocurrency market is both highly regulated and deeply adopted, making it a unique environment for traders and long-term investors. Select an exchange that fits your strategy while ensuring it aligns with Korea’s strict regulatory standards.

Choosing the right option comes down to your goals: KuCoin and MEXC suit those seeking global access and leverage, while Upbit, Bithumb, and Coinone deliver trusted local services tied directly to KRW banking. Platforms like Coincatch add social trading options for those who prefer to follow experienced investors.

Frequently asked questions

Can foreigners use South Korean crypto exchanges?

Most domestic platforms like Upbit, Bithumb, and Coinone require Korean residency, a local bank account, and real-name verification, so foreigners without this setup usually trade through global exchanges such as KuCoin or MEXC.

Which bank accounts can be linked to Korean exchanges?

Korean exchanges operate under the real-name system, meaning deposits and withdrawals must be linked to approved partner banks. For example, Upbit uses K-Bank, Bithumb works with KB Kookmin Bank, and Coinone integrates with KakaoBank.

Is crypto staking allowed in South Korea?

Yes. Exchanges such as KuCoin, MEXC, Upbit, Bithumb, and Coinone provide staking options for assets like ETH, SOL, and ADA, though services are regulated to ensure transparency and investor protection.

How secure are Korean crypto exchanges?

Licensed exchanges in South Korea must follow strict FSC rules, including cold wallet storage for at least 80% of customer assets, multi-factor authentication, and proof-of-reserves audits to safeguard user funds.

%2520(1).webp)

Written by

Antony Bianco

Head of Research

Antony Bianco, co-founder of Datawallet, is a DeFi expert and active member of the Ethereum community who assist in zero-knowledge proof research for layer 2's. With a Master’s in Computer Science, he has made significant contributions to the crypto ecosystem, working with various DAOs on-chain.

.webp)

.webp)