Best Crypto Exchanges in Thailand in 2025

.webp)

Summary: Thailand regulates cryptocurrency under strict Securities and Exchange Commission (SEC) oversight, allowing investment but prohibiting its use as legal tender for payments. Thai investors can access SEC-regulated exchanges that support Thai baht (THB) deposits.

Here are the top global crypto trading platforms operating in Thailand:

KuCoin is the top cryptocurrency exchange in Thailand thanks to its diverse digital asset selection, acceptance of THB deposits and Thai language interface.

Available Markets

900+ Cryptocurrencies

Trading Fees

0.1% Spot Trading Fees

THB Deposit Methods

Credit Card, Debit Card, Bank Transfer

Top Crypto Trading Platforms in Thailand

Thailand has emerged as one of the leading regulated crypto markets in Asia, where trading and investing in digital assets is permitted under strict oversight from the Thai Securities and Exchange Commission (SEC). The table below highlights the most reliable crypto platforms, comparing fees, supported assets, user accessibility, and Thai Baht (THB) deposit methods.

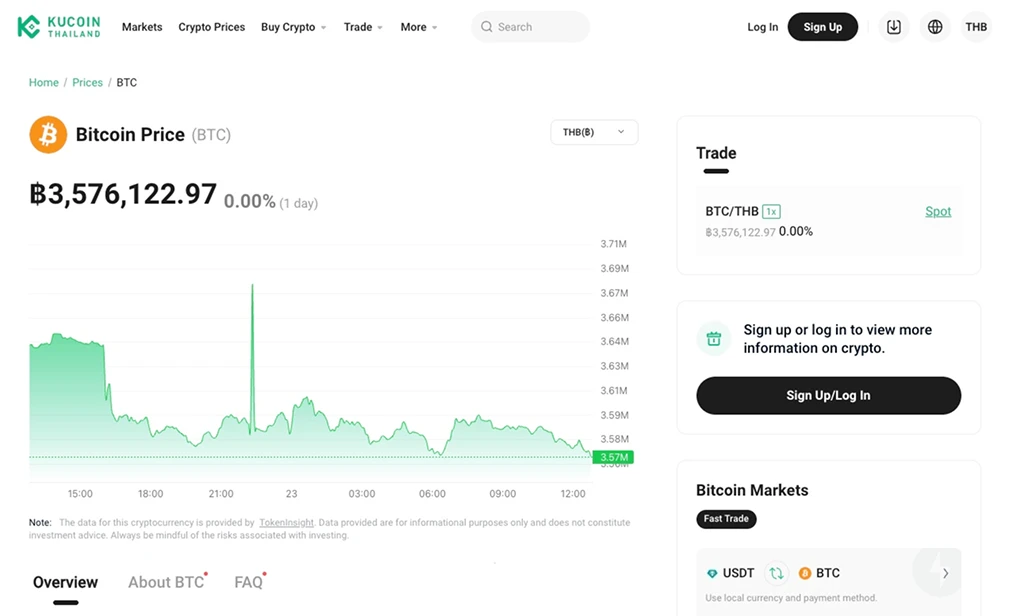

1. KuCoin - Best Crypto Exchange in Thailand

KuCoin is one of the largest global crypto trading platforms, serving 40 million registered customers worldwide. With daily volumes surpassing US$5.5 billion and a catalog of 900+ digital assets, it offers Thai traders one of the deepest markets for both mainstream and emerging assets.

The platform is translated into 20+ languages, including English and Thai, which makes onboarding easy for local users. Traders can access spot markets, futures with leverage, margin positions, and leveraged tokens, while passive investors use KuCoin Earn for staking, savings, and lending.

KuCoin maintains a Proof of Reserves (PoR) system, demonstrating that user balances are fully backed, and it invests heavily in encryption, cold storage, and account protection tools. THB deposits are available through peer-to-peer markets as well as Visa, Mastercard, and bank transfers.

Platform Highlights:

- Fees: Spot trades from 0.1%, with discounts for KuCoin Token (KCS) holders.

- Supported Assets: 900+ cryptocurrencies.

- Regulation & Licensing: KuCoin Thailand (Kucoin.th) is registered with the SEC (License No 310180130003 & 310280090003).

- THB Deposit Methods: P2P trading, credit card, debit card, Apple Pay, Google Pay, and international bank transfers.

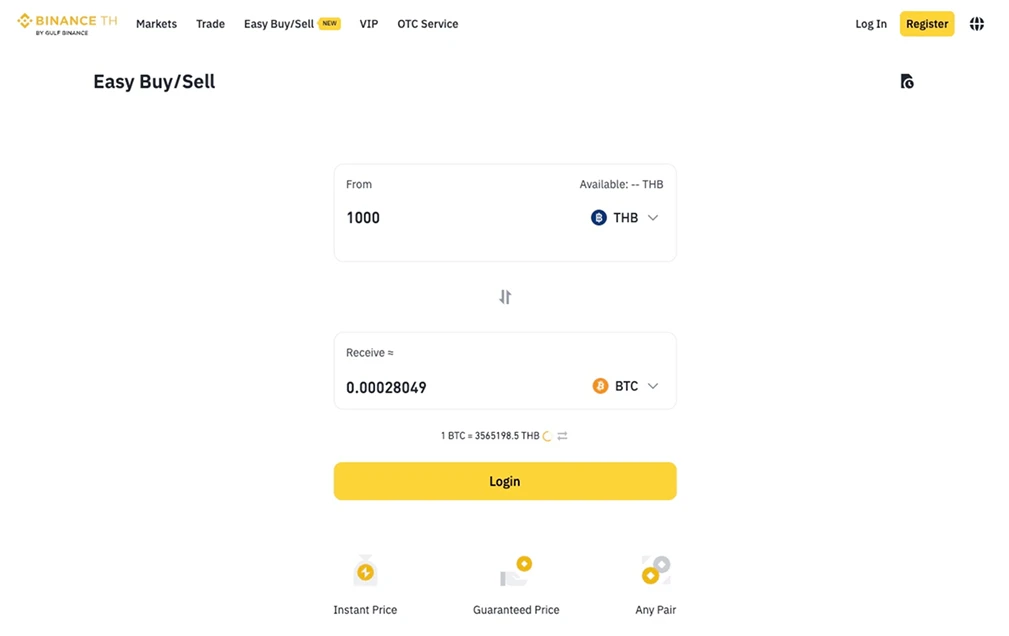

2. Binance - Popular Option for Copy Trading

Binance is the world’s largest crypto exchange, trusted by more than 289 million registered users across 180+ countries, offering a multilingual interface accessible in Thai. It supports over 350 digital assets, giving Thai investors access to deep liquidity across BTC, ETH, and a wide range of altcoins.

Users can trade spot, margin, and futures contracts, or explore passive income through Binance Earn, which includes flexible and locked savings, crypto loans, and Launchpool rewards. Binance has also built out its NFT marketplace, where users can buy, trade, and stake NFTs.

For beginners, the built-in Copy Trading marketplace allows users to follow professional strategies in real time. In Thailand, Binance access often runs through P2P (peer-to-peer) trading markets, where users can fund their accounts with Thai Baht (THB) using bank transfers and e-wallets.

Platform Highlights:

- Fees: Spot trades from 0.1%, with discounts for BNB token users.

- Supported Assets: 350+ cryptocurrencies.

- Regulation & Licensing: Gulf Binance has been granted digital asset operator licenses by the Thailand Ministry of Finance through the SEC in Thailand.

- THB Deposit Methods: Bank transfers, debit cards, credit cards, and P2P trading.

3. Gate - Invest in 3,600+ Cryptocurrencies

Gate has become a trusted exchange for over 38 million traders worldwide, offering access to more than 3,600 cryptocurrencies. Founded in 2013, it has grown into a top-tier platform for altcoin discovery, making it one of the top choices for Thai investors who want exposure to new tokens.

The platform covers everything from spot and futures markets to Simple Earn, which offers APYs up to 10.5% on flexible deposits. Gate also provides copy trading, a Launchpad for early token access, and the GateToken (GT) utility coin, which gives holders fee discounts and other platform benefits.

While it operates as an offshore exchange and is not licensed by the Thai SEC, its 123.98% reserve ratio (verified reserves exceeding liabilities) and transparent operations provide added reassurance for traders. It also accepts THB deposits, and the interface is accessible in Thai.

Platform Highlights:

- Fees: Spot trades start at 0.2%, VIP users get tiered discounts.

- Supported Assets: 3,600+ cryptocurrencies.

- Regulation & Licensing: Offshore registration, not licensed by the Thai SEC.

- THB Deposit Methods: P2P trading only.

.webp)

4. MEXC - Trade Futures with 500x Leverage

MEXC is a go-to platform for aggressive traders in Thailand thanks to its futures markets with leverage up to 500x and ultra-low fees. Founded in 2018, it supports more than 2,700 spot pairs and 1,400+ futures contracts and regularly ranks among the top exchanges for derivatives volume.

What separates MEXC from many exchanges is its fee structure. Spot trades start at 0% maker and 0.05% taker, while futures are priced at 0% maker and 0.02% taker. The platform also runs Kickstarter campaigns and Launchpool staking, where users can earn new tokens, sometimes at high APRs.

Security is reinforced by the Guardian Fund, a US$100 million reserve that covers unexpected platform risks, combined with proof-of-reserves and an insurance fund for extreme market volatility. Thai traders can fund accounts using P2P THB markets, Visa/Mastercard, and crypto deposits.

Platform Highlights:

- Fees: Spot starts from 0% maker and 0.05% taker.

- Supported Assets: 2,700+ cryptocurrencies.

- Regulation & Licensing: MEXC is registered with the Thai SEC.

- THB Deposit Methods: Debit cards, credit cards, Apple Pay, Google Pay and P2P trading.

5. Bitkub - Top Thai Cryptocurrency Exchange

Bitkub, based in Bangkok, is a familiar on-ramp for locals seeking direct THB trading under a fully SEC-regulated setup. For everyday investors, the draw is simple: clear Thai-language support, deep THB pairs for major coins, and a listed KUB market for the platform’s native token.

The product mix focuses on spot trading in over 200 cryptocurrencies paired with THB, fast account onboarding, and a polished iOS/Android app backed by 24/7 customer support. Funding is straightforward with direct transfers from major Thai banks like Krungsri and Thai QR Payment.

Security and compliance are front and center. Custody is handled by BitGo and Coinbase Custody; the exchange publishes ISO 27001 and ISO 27701 certifications and maintains AML/CFT policies, a bug-bounty program, and operational alerts when wallets pause or resume.

Platform Highlights:

- Fees: Spot trading 0.25%.

- Supported Assets: 220+ cryptocurrencies.

- Regulation & Licensing: Registered with the Thai SEC.

- THB Deposit Methods: Thai QR Payment, local bank transfers.

.webp)

6. Upbit - Recommended for Beginners

Upbit Thailand is a dedicated platform for Thai traders that delivers a clean, beginner-friendly experience backed by the infrastructure of a major global exchange. The platform lists 193 digital assets across 282 markets, pairing a straightforward interface with quick order routing and strong uptime.

Beyond the basics, Upbit provides tools to help new investors. Trends & market data surfaces active coins and liquidity pockets, while watchlists and custom alerts make it easy to track entries. The wallet experience is also simple; deposits and withdrawals are clearly labeled.

Compliance and safety are core to Upbit’s pitch in Thailand. The exchange is regulated by the Thai SEC, runs 24/7 security monitoring, and is built on financial-institution-grade systems. Funding supports local bank transfers and THB QR deposits, simplifying the funding process.

Platform Highlights:

- Fees: Spot trading starts at 0.25%.

- Supported Assets: 190+ cryptocurrencies.

- Regulation & Licensing: Licensed in Thailand (Ministry of Finance) and regulated by the Thai SEC.

- THB Deposit Methods: Local bank transfers and THB QR deposits.

.webp)

Is Crypto Regulated in Thailand?

Thailand has developed a robust regulatory framework for digital assets. The Office of the Securities and Exchange Commission (SEC) is the main regulator under the Emergency Decree on Digital Asset Businesses B.E. 2561 (2018), recently updated by Emergency Decree No. 2 B.E. 2568 (2025).

Key elements of regulation include:

- Licensing: Any exchange, broker, or wallet service operating in Thailand, including foreign platforms that target Thai users, must register with or be licensed by the SEC.

- Foreign entity oversight: The 2025 law clarifies that platforms outside Thailand providing services to Thai persons must also comply with Thai regulations. Unlicensed foreign platforms like Bybit and OKX will be blocked under the new rules.

- Use as payment: While trading, holding, and investing in digital assets is permitted (under license), using cryptocurrencies broadly as a means of payment for goods and services is restricted.

- Consumer protection & disclosure: Regulatory changes emphasize protecting investors, requiring digital asset businesses to meet standards for transparency, system stability, safeguarding customer assets, and disclosing risks.

- Anti-Money Laundering/Counter-Terrorism Financing (AML/CFT): All licensed digital asset businesses are treated similarly to financial institutions for AML/CFT purposes. They must perform customer due diligence, maintain records, and report suspicious transactions.

Overall, Thailand’s crypto regulation reflects a strategy of measured support: enabling business and technology innovation, but under a strong legal framework designed to protect investors, reduce illicit finance risks, and maintain financial stability.

How is Crypto Taxed in Thailand?

As of January 1, 2025, Thailand’s Revenue Department introduced a major reform in how digital assets are taxed, especially for individual investors (resident or non-resident).

Capital gains from trading cryptocurrencies or digital tokens are now exempt from personal income tax so long as those trades take place through local digital asset exchanges, brokers, or dealers licensed by the SEC. This tax break runs through December 31, 2029.

Gains made via unlicensed or offshore platforms are not covered by the exemption and taxed as part of personal income, up to 35% in the highest bracket. Companies are also not eligible for this exemption and remain subject to corporate income tax, which goes up to 20% for net profits exceeding THB 3 million.

Cryptocurrency Adoption in Thailand

According to Statista Market Insights, Thailand currently has around 8.2 million crypto users in 2025, corresponding to roughly 11.6% of the population. By 2026, the number of users is expected to reach 8.43 million, giving the market a user penetration rate of nearly 12%.

The rising adoption is driven by clear regulation, with the Thai SEC licensing exchanges that support the Thai Baht and setting standards for transparency and consumer protection.

How to Buy Bitcoin in Thailand

The safest way to buy Bitcoin (BTC) in Thailand is through exchanges licensed by the Thai Securities and Exchange Commission (SEC) or reputable global platforms that accept Thai users and follow strict AML and KYC requirements.

- Choose a Licensed Exchange: Select a trusted platform available in Thailand that supports Thai Baht (THB) deposits. Look for SEC-licensed operators or major international exchanges with a strong compliance record.

- Register and Verify: Open an account and complete identity verification using a Thai national ID, passport, or driver’s license. This ensures compliance with KYC and AML laws.

- Deposit Thai Baht (THB): Fund your account through local bank transfers supported by Kasikorn Bank, Siam Commercial Bank, Bangkok Bank, or use cards such as Visa and Mastercard. Many platforms also offer P2P marketplaces for flexible payment methods.

- Buy Bitcoin (BTC): Go to the BTC/USDT or BTC/THB trading pair, enter the amount you want to purchase, and confirm the order.

For maximum safety, transfer your BTC to a private wallet. Hardware wallets such as Ledger or Trezor are the most secure choice, while regulated mobile wallets are convenient for smaller transactions.

Final Thoughts

Thailand has built one of Asia’s most structured environments for digital assets, giving investors clear rules, licensed exchanges, and strong consumer protections.

By prioritizing regulated platforms and secure custody practices, investors can safely participate in one of Asia’s most structured digital asset markets while positioning themselves for long-term opportunities.

Frequently asked questions

Can foreigners trade cryptocurrency in Thailand?

Yes, foreigners can trade crypto in Thailand as long as they use exchanges licensed by the Thai SEC. However, offshore platforms without approval may be blocked under current laws.

Do Thai banks support cryptocurrency deposits and withdrawals?

Several major Thai banks, including Kasikorn Bank and Siam Commercial Bank, integrate with licensed exchanges, allowing users to fund accounts via THB bank transfers or QR payments.

How are crypto staking and lending taxed in Thailand?

Income from staking or lending is generally taxable, even during the 2025-2029 capital gains exemption. Investors should report these earnings as part of assessable income to remain compliant.

Are offshore crypto exchanges legally allowed to offer services to Thai residents?

Yes, but only under tighter conditions as of 2025. If a foreign exchange targets Thai users (e.g. accepts Thai Baht payments, uses Thai language support, or markets to Thai residents), it must obtain a license from the SEC. If not licensed, such platforms risk being blocked.

%2520(1).webp)

Written by

Tony Kreng

Lead Editor

Tony Kreng, who holds an MBA in Business & Finance, brings over a decade of experience as a financial analyst. At Datawallet, he serves as the lead content editor and fact-checker, dedicated to maintaining the accuracy and trustworthiness of our insights.

.webp)

%2520(1).webp)

.webp)