Best Inverse Perpetual Contract Exchanges for 2025

%2520(1).webp)

Summary: Inverse perpetual contracts are crypto futures that settle in the base asset, like BTC or ETH, rather than a stablecoin. They are offered by centralized exchanges and are commonly used by traders who want to build directional exposure while keeping margin and PnL denominated in crypto.

To help investors find the most reliable platforms for this type of trading, we researched 20+ centralized exchanges, tested execution quality, and compared key product features across them. The following seven stood out for their inverse contract support, leverage options, and platform performance:

- Bybit - Leading Platform for Inverse Perpetual Trading

- Binance - Popular Alternative for Coin-Margined Futures

- OKX - Recommended Choice for Traders in Asia

- MEXC - Offers High Leverage for Inverse Perpetuals

- Gate.io - Ideal for Bitcoin Inverse Perpetual Trading

- Bitget - High-Leverage Alternative for Inverse Perpetuals

- HTX - Great for Trading Coin-Margined Altcoins Contracts

Bybit leads the space in inverse perpetual trading with unmatched execution stability, customizable leverage controls, and true crypto-native margin support for BTC and ETH settled contracts.

Supported Contracts

1,800+ Cryptocurrencies (Spot, Inverse, USDT Futures & Options)

Trading Fees

Starting at 0.02% Maker Fees and 0.055% Taker Fees

Coin-Margined Collateral Options

BTC, ETH, BIT, SOL, XRP, ADA, and several others

Best Inverse Crypto Perpetual Platforms

We reviewed over 20 exchanges offering inverse or coin-margined perpetual contracts and narrowed it down to the 7 that offer the best mix of liquidity, leverage, product design, and reliability. Platforms were evaluated based on trading features, available markets, fee structure, and overall user experience.

Below is a comparison of supported assets, fee structure, max leverage, and features for each platform:

Exchange | Cryptocurrencies | Trading Fees | Leverage | Notable Features |

|---|---|---|---|---|

1800+ | 0.02% maker, 0.055% taker | Up to 100x | Clean UI, live testnet, native bracket orders | |

400+ | 0.02% maker, 0.04% taker | Up to 125x | Multi-asset mode, deep liquidity, risk indicators | |

300+ | 0.02% maker, 0.05% taker | Up to 100x | Asian fiat ramps, advanced execution controls | |

3000+ | 0% maker, 0.02% taker | Up to 200x | High alt leverage, loose restrictions, fast fills | |

3800+ | 0.015% maker, 0.05% taker | Up to 100x | BTC-M only, iceberg orders, TP/SL tools included | |

740+ | 0.02% maker, 0.06% taker | Up to 125x | Fast interface, batch orders, reliable API access | |

700+ | 0.02% maker, 0.04% taker | Up to 200x | Altcoin depth, reverse grid bots, coin settlement |

1. Bybit

Bybit is one of the few exchanges where inverse perpetual contracts aren’t just supported, they’re prioritized. The platform appeals to traders who actively manage BTC or ETH exposure, preferring to use crypto as both margin and settlement without converting into stablecoins or stablecoin equivalents.

Bybit’s layout and product structure make it easy to stay in crypto while using advanced position controls. Traders can easily adjust between isolated and cross margin setups per position. Charting is clean, bracket orders are built-in, and the platform holds up under pressure during large price swings and volatility bursts.

Per-position custom leverage, take-profit/stop-loss automation, and ladder order execution are all supported natively. Most long-term users stick with Bybit for its consistency, as the app rarely crashes and the execution is fast. The platform handles high-frequency activity well without layering in unnecessary distractions.

Exchange Highlights:

- Fees: Maker fee of 0.02%, taker fee of 0.055%.

- Leverage: Up to 100x for BTCUSD inverse perpetual contracts.

- Assets: Inverse perpetual contracts available for BTC/USD, ETH/USD, and XRP/USD.

- Deposit Methods: Crypto, bank transfers, credit/debit cards, Google Pay, Apple Pay.

2. Binance

Binance offers a full suite of derivatives products, including coin-margined futures that mirror the structure of inverse perpetual contracts. These contracts are settled in the base cryptocurrency, making Binance a great option for traders who want coin-denominated exposure at the highest standard.

Top contracts like BTCUSD and ETHUSD support up to 125x leverage, and tools like Multi-Asset Mode let users move margin between USDⓈ-M and COIN-M without friction or manual transfers. Portfolio margin is available for high-volume users, offering capital efficiency across positions and assets.

Add-ons like auto-deleveraging (ADL) controls and risk indicator widgets make the experience suitable for institutional setups. Experienced traders praise the liquidity, especially during volatile events where Binance often outperforms on slippage.

Exchange Highlights:

- Fees: Maker fee of 0.02%, taker fee of 0.05% for Coin-Margined Futures.

- Leverage: Offers up to 125x leverage on select coin-margined futures contracts.

- Assets: Coin-margined futures contracts, including BTC, ETH, BNB, and various altcoins.

- Deposit Methods: Bank transfers, crypto deposits, credit/debit cards, WeChat Pay, P2P, and more.

3. OKX

OKX has built deep traction across Asia, with localized support, fiat ramps, and trading tools that attract serious derivatives users in competitive markets. Its inverse contracts are competitive, especially for traders who want to keep everything in-crypto across major and mid-cap pairs without hassle.

The exchange frequently launches promotions targeting high-frequency and volume-based accounts across Korea, Japan, and Vietnam. Execution during news-driven spikes holds up better here than on many Western platforms, while BTC and ETH coin-margined contracts support up to 125x leverage.

The availability of post-only, reduce-only, and trigger-based limit orders shows its commitment to professional setups. Users often highlight the variety of pairs available in coin-margined format, including alts like APT, DOGE, and DOT. Mobile experience is strong, though beginners may find the layout a bit cluttered.

Exchange Highlights:

- Fees: Maker fee of 0.02% and a taker fee of 0.05%, and tiered VIP discounts (volume or OKB holdings).

- Leverage: Provides up to 100x leverage on crypto-margined perpetual futures contracts.

- Assets: Variety of crypto-margined futures contracts, including BTC, ETH, LTC, XRP, and several others.

- Deposit Methods: Cryptocurrency deposits, as well as fiat deposits through various regional bank.

4. MEXC

MEXC pushes the envelope on leverage and low fees, making it attractive to risk-tolerant traders focused on short-term price swings and breakout scalping. It lists inverse contracts across a broader range of coins and many traders come to MEXC specifically for high-risk setups that other platforms restrict or delist.

Leverage goes up to 125x on BTC inverse contracts, with altcoins typically capped between 50x and 200x depending on liquidity. The UI is barebones, but fast and order placements and position adjustments are quick even during high-volatility moments.

Power users like the altcoin exposure and flexibility to size in aggressively on volatile pairs. The biggest downside flagged is occasional downtime during maintenance and a support queue that isn’t always fast or responsive. Overall, MEXC is treated as a high-stakes venue where speed and leverage shine the most.

Exchange Highlights:

- Fees: Maker fee of 0%, taker fee of 0.02% for perpetual futures trading.

- Leverage: Adjustable leverage up to 200x, with the leverage multiplier varying by contract.

- Assets: Provides inverse perpetual contracts for BTC, ETH, DOGE, SHIB, and other cryptocurrencies.

- Deposit Methods: Crypto deposits, credit/debit card purchases, and third-party payment services.

5. Gate.io

Gate.io offers a single inverse perpetual contract (BTC/USD) through its BTC-M product line. Unlike other platforms that feature a wide selection of coin-margined contracts, Gate.io sticks to one inverse product, with most other pairs available only in USDT-margined format.

The BTC-M contract supports up to 100x leverage, and margin options include both cross and isolated. Execution tools include ladder orders, iceberg orders, and configurable TP/SL options, giving traders the flexibility to manage entries and exits with precision.

While Gate.io is better known for altcoin spot and USDT-based futures markets, a small number of traders still use its inverse BTC contract for hedging or directional exposure. The UI hasn’t changed much in recent years, but execution is stable and the learning curve is minimal.

Exchange Highlights:

- Fees: 0.02% for makers and 0.05% for takers; fees can be reduced by upgrading VIP levels.

- Leverage: Up to 100x on BTC-M contracts.

- Assets: Bitcoin only for inverse perpetuals.

- Deposit Methods: Primarily supports crypto deposits; fiat deposits are available via third-party services.

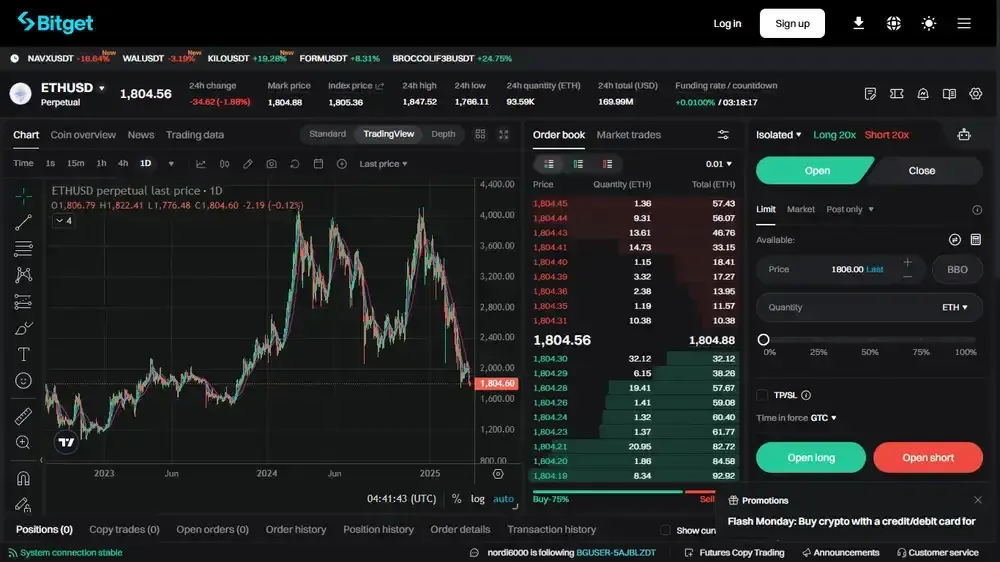

6. Bitget

Bitget leans into speed, offering a responsive UI and quick-switching tools for traders who manage multiple positions at once without needing layers of customization. Its inverse contracts feel tightly integrated into the broader trading stack, with minimal friction between features and modes.

Margin types, bracket orders, and batch trading are all easily accessible. The platform tends to appeal to scalpers and short-term directional traders who don’t want excess clutter or distractions. Smart TP/SL presets and adjustable leverage per asset make it easy to manage volatile positions.

Feedback is mixed on region-based access and KYC processes, but traders consistently mention the mobile app’s reliability. Bitget also sees steady usage from API users thanks to a stable backend and good documentation with decent uptime.

Exchange Highlights:

- Fees: Maker fee of 0.02% and taker fee of 0.06% for futures trading.

- Leverage: Provides up to 125x leverage on BTC inverse perpetual contracts.

- Assets: Offers inverse perpetual contracts for BTC, ETH, XRP, SOL, and other cryptocurrencies.

- Deposit Methods: Crypto deposits, credit/debit card purchases, and third-party payment services.

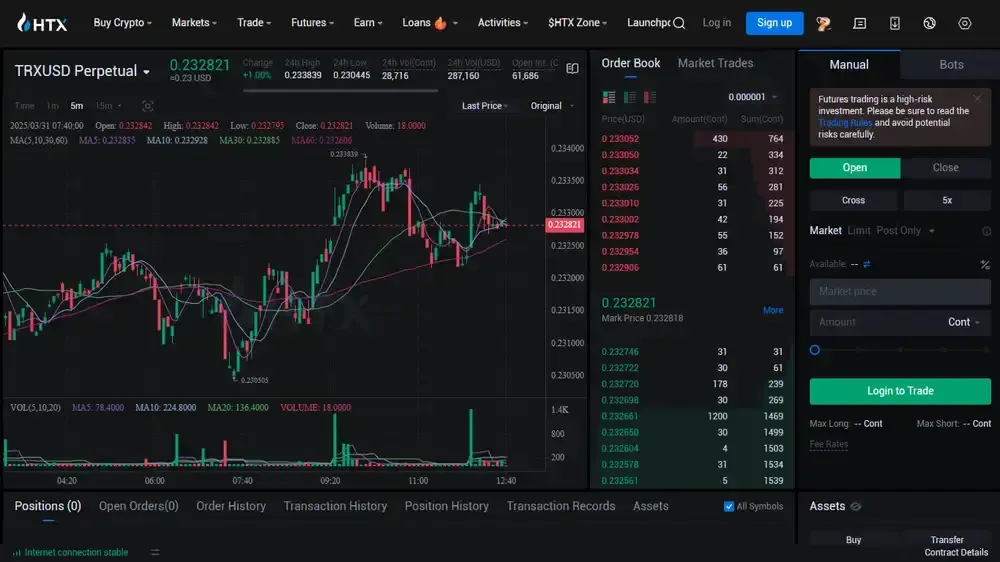

7. HTX

HTX (formerly Huobi) continues to list one of the broadest ranges of coin-margined pairs, especially across mid-cap altcoins and regional tokens. Traders interested in non-standard markets with crypto settlement often land here after exhausting options on larger exchanges.

Leverage varies; top pairs like BTC and ETH go up to 200x, while coins like TRX, BCH, and others are typically limited to 75x or less. The order system is simple but does the job, and latency is rarely an issue unless traffic surges or major events hit. HTX also supports reverse grid bots and advanced risk tools.

The biggest strength is pair variety, especially for those running hedged positions in spot vs. inverse setups. Downsides include slower support and a KYC process that occasionally hangs without notice or resolution. Still, for altcoin inverse access, it remains one of the last standing options.

Exchange Highlights:

- Fees: Maker fee of 0.02% and taker fee of 0.05% for coin-margined futures trading.

- Leverage: Up to 200x for BTC and ETH; leverage for other altcoin contracts varies, typically up to 75x.

- Assets: Wide range of coin-margined perps, including BTC, ETH, TRX, DOGE, and others.

- Deposit Methods: Crypto; fiat deposits may be available through third-party services.

What are Inverse Perpetual Contracts?

Inverse perpetual contracts are crypto futures where the contract is quoted in USD but settled in the base cryptocurrency, such as Bitcoin or Ethereum. Traders use the crypto itself as margin and receive profits or losses in that same coin, rather than in stablecoins like USDT.

These contracts behave similarly to perpetual swaps, with no expiry date and continuous funding payments between long and short positions. What makes them “inverse” is the pricing logic; instead of trading BTC/USDT, you're trading USD/BTC, which means your gains and losses are calculated in BTC terms.

They are favored by traders who want to accumulate more of the underlying asset or manage crypto-native portfolios without rotating into stablecoins. Inverse perpetuals also appeal to advanced users seeking directional setups, hedging strategies, or volatility exposure with direct crypto settlement.

Inverse Perpetual Crypto Trade Example

Let’s say a trader opens a long on the ETH/USD inverse perpetual contract at $1,900 with a take-profit at $2,000 and a stop-loss at $1,850. The position size is $9,500 worth of contracts, using 5 ETH as margin (9,500 ÷ 1,900 = 5 ETH).

ETH rallies to $2,000 and the position is closed. The trader buys back the same $9,500 notional value at the new price: 9,500 ÷ 2,000 = 4.75 ETH. The profit is the difference between entry and exit in ETH terms: 5.00 − 4.75 = 0.25 ETH profit.

Since this is an inverse contract, the gain is settled in ETH and added to the account balance. The trade results in a realized profit of 0.25 ETH, without ever using or touching stablecoins.

Risks of Trading Inverse Perpetual Contracts

While inverse perpetuals offer unique advantages for crypto-native traders, they also introduce risks that aren’t always obvious at first glance. Understanding these drawbacks is essential for anyone managing exposure directly in BTC, ETH, or other base assets.

- Double exposure to asset volatility: Gains and losses are settled in crypto, so even a profitable trade can decline in USD value if the asset drops after exit.

- Nonlinear position sizing: Contract size shrinks as price rises, meaning leverage scales unevenly and affects how risk is distributed across price levels.

- Increased margin sensitivity during drawdowns: Since collateral is denominated in crypto, a falling market reduces your margin and increases the chance of forced liquidation.

- Complex PnL tracking: Profit must be measured in both crypto and fiat terms, which complicates accounting, especially for tax reporting and cross-asset strategies.

- Limited altcoin support: Most platforms only offer inverse contracts on BTC and ETH, with fewer listings and thinner liquidity on smaller assets.

Inverse Perpetuals vs Other Types of Perpetual Contracts

Perpetual contracts all share the trait of no expiration, but differ in how margin, settlement, and exposure are structured. Inverse perpetuals stand out by using the base cryptocurrency (like BTC or ETH) for both margin and Profit and Loss (PnL), while other types may rely on stablecoins or even cross-asset margining.

Inverse Perpetuals vs COIN-Margined Contracts

COIN-margined contracts and inverse perpetuals are effectively the same financial product under different names, depending on the exchange. Both use crypto (like BTC or ETH) as margin and settlement, and both calculate PnL in the base asset instead of stablecoins or fiat.

The key advantage is maintaining exposure and returns in crypto without converting to USD or USDT. Since these contracts don’t expire, traders can hold positions indefinitely, making them useful for longer-term strategies and directional setups.

USDT Perpectual vs Inverse Perpetuals

USDT perpetuals are linear contracts with price, margin, and profit all measured in stablecoins; ideal for users managing risk in USD terms. They offer predictable exposure sizing and are favored in cross-margin systems and multi-asset accounts.

Inverse perpetuals introduce nonlinear PnL behavior because gains are earned in crypto and position size varies with price. They’re better suited for traders seeking to grow coin balances or hedge without stablecoin exposure, but require more precise position sizing.

Final Thoughts

Each of the seven exchanges covered here brings something unique to inverse perpetual trading, whether it's Bybit’s clean execution, OKX’s regional depth, or MEXC’s altcoin leverage flexibility.

While the core mechanics of inverse contracts are the same across platforms, margin options, interface design, supported assets, and risk tools vary more than most traders expect.

Choosing the right venue depends on your strategy: some prioritize leverage ceilings, others care about cross-margin precision, mobile execution, or altcoin depth.

Frequently asked questions

Can I use inverse perpetuals for long-term hedging?

Yes, inverse perpetuals are commonly used by miners or long-term holders to hedge against downside while keeping exposure in the same crypto. Because they have no expiration and are settled in coin, they’re well suited for non-stablecoin hedging strategies.

Do inverse perpetual contracts have funding fees?

Like other perpetual futures, inverse contracts include funding rate payments exchanged between longs and shorts every 8 hours. This rate varies by market conditions and can flip positive or negative depending on whether long or short positions dominate.

Are inverse perpetuals riskier than USDT-based contracts?

They carry different risks: inverse contracts expose your PnL to crypto price swings twice. Once from the market move, and again from settlement in the base asset. This “double volatility” means gains can be amplified, but so can drawdowns if price moves against your position.

How is liquidation price calculated in an inverse contract?

Liquidation is determined based on the value of your position relative to margin, but in inverse contracts, calculations are done in crypto terms using inverse price logic. As price falls (for longs), not only does your margin shrink, but your position size effectively expands, accelerating liquidation risk.

Written by

Antony Bianco

Head of Research

Antony Bianco, co-founder of Datawallet, is a DeFi expert and active member of the Ethereum community who assist in zero-knowledge proof research for layer 2's. With a Master’s in Computer Science, he has made significant contributions to the crypto ecosystem, working with various DAOs on-chain.

.webp)