Jito Explained: JitoSOL, Bundles, Restaking & BAM

Summary: Jito Network is a protocol on Solana that lets users stake SOL and earn extra rewards by capturing MEV alongside staking yields through the JitoSOL token. It uses tools like transaction bundles and a block auction system to maximize validator profits and network speed.

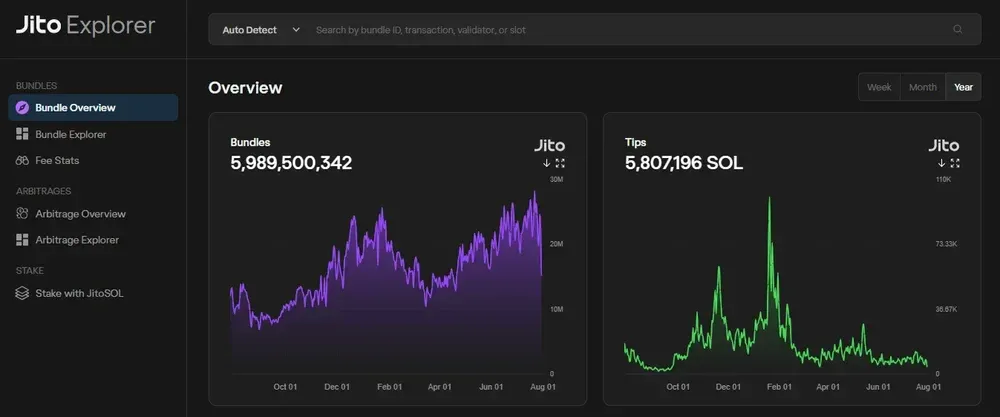

Validators, traders, and stakers use Jito, with about 41% of Solana’s stake weight running its client. In the past year, Jito processed nearly 6 billion bundles, generating over 5.8 million SOL in tips and delivering around 7% Annual Percentage Yield (APY) to users.

Jito Network is Solana’s leading MEV-powered liquid staking protocol, optimizing validator rewards and enhancing staking yields through innovations like restaking and BAM.

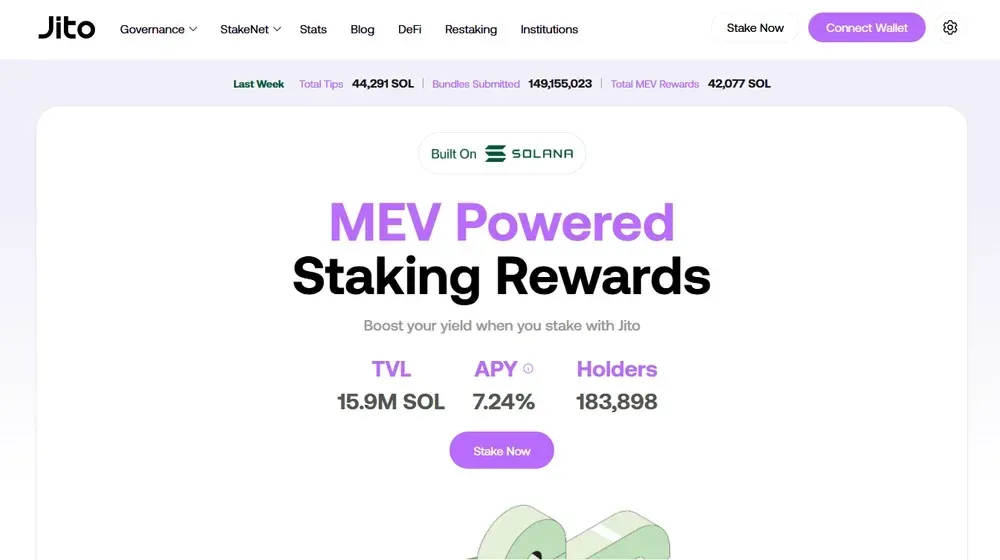

Total Value Locked (TVL)

15.9 million SOL ($2.92 billion)

Liquid Staking Yields

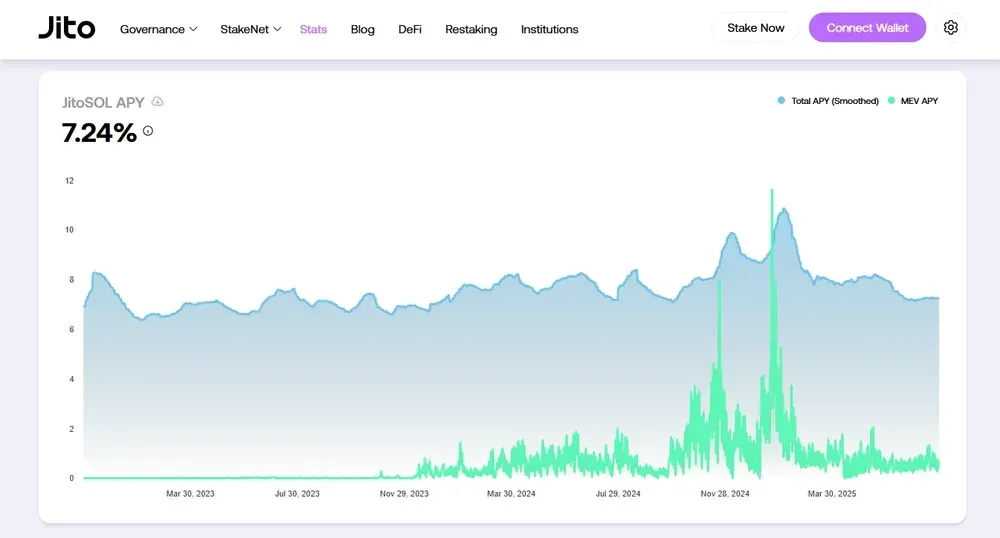

~7.24% APY + MEV rewards

Fees

~0.3% Validator Commission

What is Jito Network?

Jito Network is a liquid staking and Maximum Extractable Value (MEV) protocol on Solana, allowing users to stake SOL and earn higher rewards. When staking through Jito, participants receive JitoSOL, a liquid staking token accruing regular staking rewards plus MEV-generated transaction fees.

Jito incorporates a Solana staking pool with specialized infrastructure, capturing extra value by optimizing transaction order and block inclusion. By distributing captured MEV earnings back to stakers, Jito boosts yields for over 180 thousand holders, while simultaneously striving to raise network efficiency.

According to DeFiLlama, Jito Network currently has a Total Value Locked (TVL) of approximately $2.92 billion, making it the largest staking protocols on Solana. Additionally, Jito utilizes the MEV-optimized validator client Jito-Solana, which supports roughly 41% of Solana's staked stake weight across 225 distinct validators.

How Does Jito Network Work?

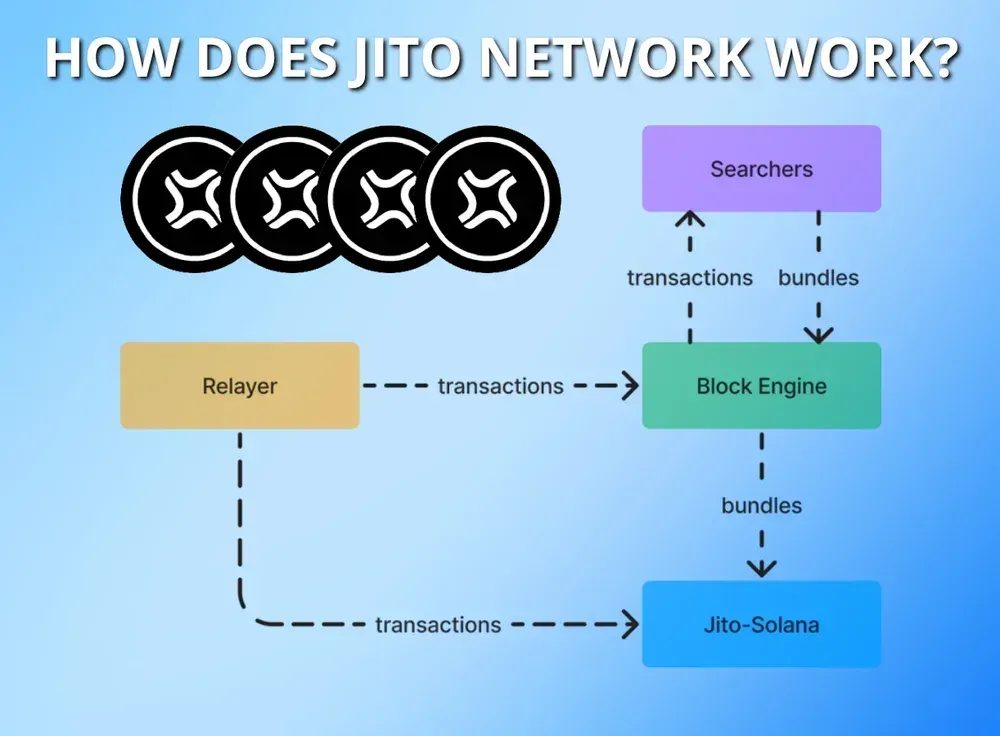

At its core, Jito is a Solana stake pool with an MEV-boosted validator set. Users staking SOL receive JitoSOL, a liquid staking token currently worth ~1.22 SOL that appreciates over time due to staking rewards and MEV earnings. Here's how Jito works behind the scenes:

- Bundles: Transactions grouped by traders into ordered sequences, capturing MEV opportunities and executing atomically or not at all to control execution.

- Relayer: Filters and orders incoming bundles, ensuring only the most profitable transactions reach validators, thereby reducing spam and optimizing efficiency.

- Block Engine: Runs an off-chain auction each block, selling blockspace to the highest bidder, thus reducing congestion and maximizing validator profitability.

- MEV Reward Distribution: Accumulated MEV fees ("tips") are collected each epoch and then distributed primarily to validators and stakers, boosting their overall yield.

- StakeNet: Autonomously manages stake allocations to top-performing validators based on uptime, performance, and MEV contributions, optimizing both yields and network health.

- Auction System: Jito uses an advanced MEV auction system to prioritize transaction order, reducing spam and easing congestion on the Solana network.

From our perspective, Jito’s approach converts what could be a negative (MEV causing congestion) into a positive (MEV fees as extra yield). By aligning incentives of traders, validators, and stakers, Jito’s architecture is meant to make Solana faster and more rewarding for participants.

What are Jito Bundles?

Jito Bundles are a feature on Solana that enable users to group multiple transactions together, ensuring they all succeed or fail as a single unit. This allows complex tasks, such as MEV arbitrage or DeFi liquidations, to execute atomically within the same Solana block.

Validators prioritize these bundles based on user-provided tips, encouraging faster processing and ensuring transactions occur exactly in the specified order. According to the Jito Bundle Explorer, nearly 6 billion bundles were processed through Jito in the past 365 days, generating over 5.8 million SOL in validator tips.

How to Use Jito Network

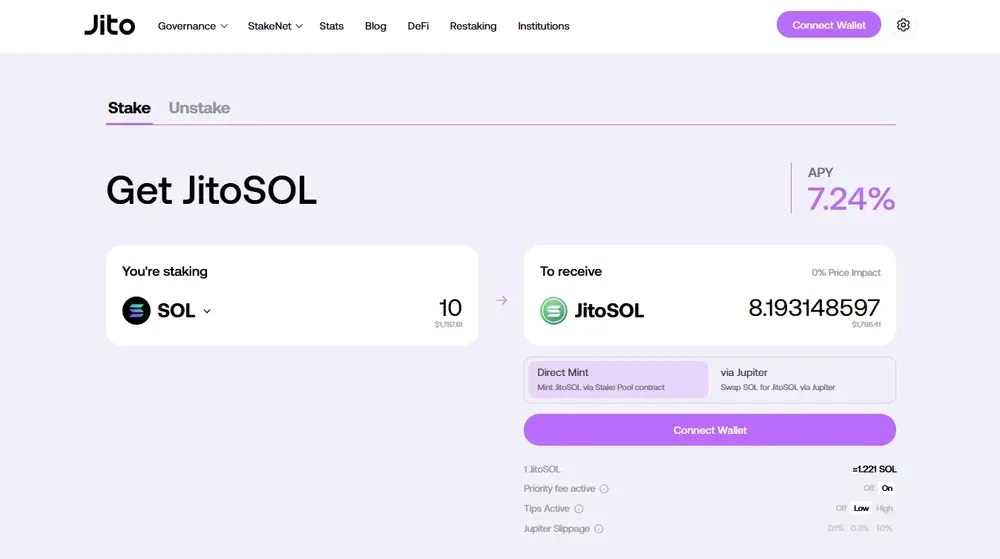

Using Jito for staking is straightforward, even for users new to Solana. The platform allows you to easily stake SOL tokens, earn superior yields, and utilize your JitoSOL tokens in various DeFi strategies.

Getting started is simple:

- Acquire SOL tokens in a Solana-compatible wallet like Phantom or Solflare.

- Visit Jito Network’s official staking app and deposit SOL using the one-click staking interface.

- Receive JitoSOL tokens at a 1:1 rate, automatically accruing rewards over time.

- Alternatively, swap SOL or other tokens for JitoSOL via a decentralized exchange like Jupiter.

- Hold your JitoSOL to earn staking rewards plus additional MEV yield, or use it within DeFi platforms.

- When ready, unstake via Jito’s app (takes about 2-3 days) or swap JitoSOL back to SOL on a DEX.

Additionally, validators can boost earnings by running the Jito-Solana client, attracting more delegations and increasing per-block revenue with minimal risk. Developers and traders can use Jito’s APIs and SDKs to submit atomic transaction bundles, enabling secure strategies like arbitrage without front-running.

JitoSOL APY Explained

JitoSOL offers a competitive Annual Percentage Yield (APY) by accruing both staking rewards and additional MEV-generated value. The token’s value continuously increases relative to SOL, resulting in an annual yield currently averaging around 7.24%. How JitoSOL yield accumulation works:

- Reward-Bearing Mechanism: JitoSOL tokens maintain a fixed quantity while their value relative to SOL increases through accumulated staking and MEV rewards.

- Dynamic Exchange Rate: Each JitoSOL is currently worth approximately 1.221 SOL, reflecting compounded rewards accrued since initial staking.

- Automatic Compounding: Rewards earned by validators automatically grow the total SOL held in Jito’s staking pool without minting additional tokens.

- DeFi Yield Strategies: Users can further increase yield via DeFi platforms, such as providing liquidity in JitoSOL-SOL pools on Kamino, utilizing looping strategies, or borrowing/lending on Drift.

- Redemption Gains: Upon unstaking, users redeem their JitoSOL for more SOL than originally deposited, directly reflecting accumulated staking and MEV rewards.

What is Jito Restaking?

Jito Restaking allows users to earn extra rewards by staking their tokens to help secure multiple projects simultaneously on Solana. Similar to Ethereum’s EigenLayer, Jito lets you reuse staked assets to support different networks, increasing your earning potential.

When you restake with Jito, you receive liquid tokens called Vault Receipt Tokens (VRTs), which represent your original staked assets. These tokens remain usable in Solana’s DeFi ecosystem, meaning you can still trade, lend, or borrow while your tokens are staked.

JTO Tokenomics

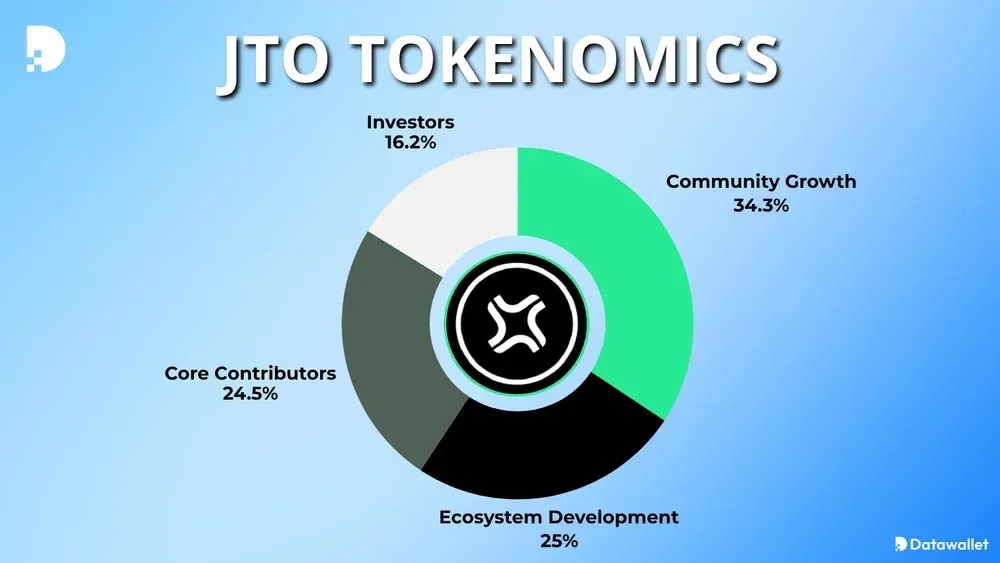

The Jito Governance Token (JTO) underpins the governance of Jito Network, decentralizing protocol control and aligning incentives among stakeholders. Designed for broad distribution, it emphasizes community participation, ongoing development, and rewarding early contributors.

Key aspects of JTO tokenomics:

- Fixed Supply: JTO has a total fixed supply of 1 billion tokens, distributed across community, development, team, and investor categories.

- Community Growth (34.3%): The largest allocation, including a 10% airdrop to early users, validators, and JitoSOL holders, plus DAO-held tokens.

- Ecosystem Development (25%): Reserved by the Jito Foundation for funding continued research, ecosystem grants, new features, and public-good initiatives.

- Core Contributors (24.5%): Allocated to founders, current and future team members, with tokens vesting over three years after a one-year cliff.

- Investors (16.2%): Tokens allocated to early backers and venture firms, vesting over three years with a one-year cliff to ensure alignment.

- Governance Utility: JTO holders participate in governance decisions, voting on protocol parameters, validator policies, treasury allocation, and system upgrades.

- MEV Revenue Sharing: JTO stakers earn a share (0.15%) of all MEV tips generated, incentivizing active participation and aligning value accrual.

- Long-Term Stability: Jito avoided public token sales, opting for retrospective airdrops and gradual allocations to encourage sustained holding and involvement.

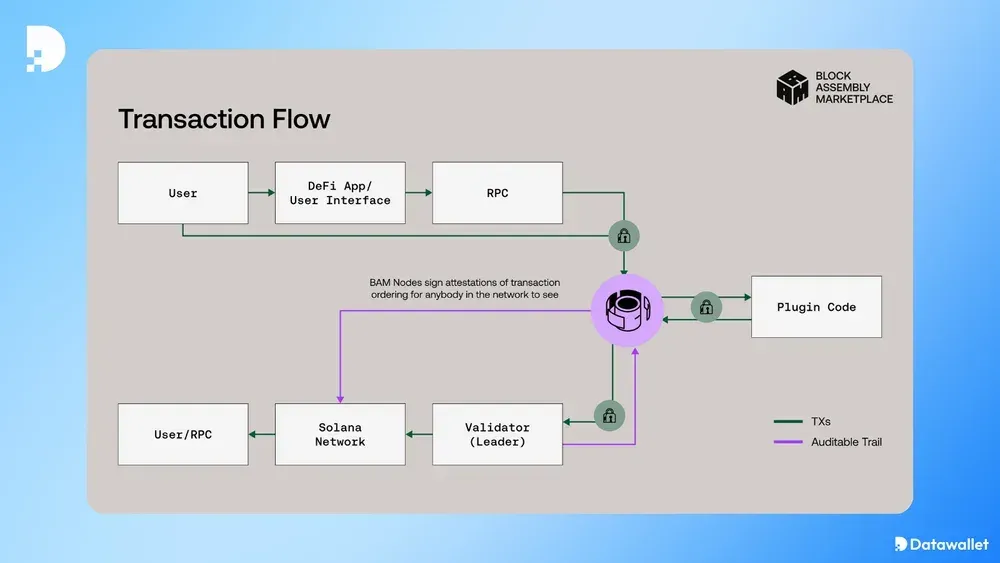

Jito's Block Assembly Marketplace (BAM) Explained

Jito’s Block Assembly Marketplace (BAM), introduced on July 21, 2025, is a new system for assembling blocks and sequencing transactions on Solana. It overhauls the existing block engine, making it more open, modular, transparent, and distributed through independently operated scheduler nodes.

BAM uses independent scheduler nodes ("BAM Nodes") running secure hardware enclaves (TEEs) to privately organize and simulate incoming transaction bundles. Validators then verify cryptographic attestations from these nodes, ensuring transaction ordering was computed correctly before producing the final blocks onchain.

A key innovation of BAM is its "Plugins" feature, allowing developers to integrate custom rules into transaction ordering processes. This programmable blockspace creates new revenue opportunities and increases fairness and transparency, reducing harmful MEV tactics like frontrunning attacks.

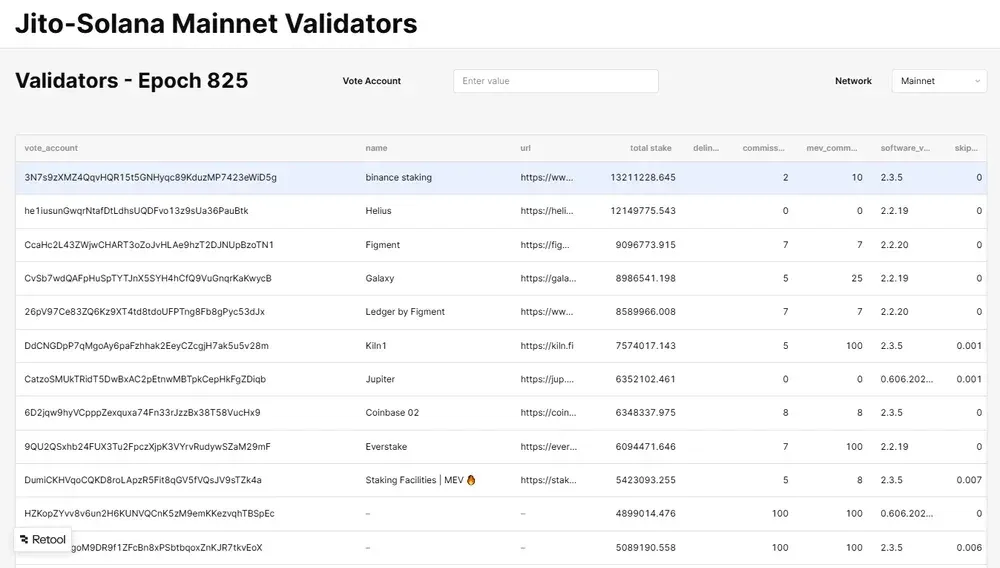

Best Jito Validators

Choosing the right validator is essential to maximizing staking rewards and ensuring network security. The best Jito validators are trusted operators with substantial staked SOL and low commission rates.

Here are some top-performing validators on Jito:

- Binance Staking: 13.2M SOL staked with 0.3% commission.

- Helius: 12.1M SOL staked with 0.3% commission.

- Figment: 9.1M SOL staked with 0.3% commission.

- Galaxy: 9.0M SOL staked with 0.3% commission.

- Ledger by Figment: 8.6M SOL staked with 0.3% commission.

- Kiln1: 7.6M SOL staked with 0.3% commission.

- Jupiter: 6.4M SOL staked with 5.1% commission.

- Coinbase 02: 6.3M SOL staked with 0.3% commission.

According to the Jito Mainnet Validator Dashboard, these validators offer a strong balance of performance, low fees, and MEV revenue sharing, making them top choices for JitoSOL stakers.

Risks When Using Jito

Although Jito provides profound benefits, users must also understand the potential risks involved. These range from technical vulnerabilities and market competition to centralization concerns and regulatory scrutiny.

Key risks to consider:

- Centralization Risk: High adoption of Jito’s validator client (over 80%) might create a single point of failure, reducing Solana’s decentralization.

- Competitive Market: Increased competition from other staking platforms like Marinade could reduce JitoSOL’s yield advantage, potentially affecting adoption and growth.

- Smart Contract Vulnerabilities: Software bugs in Jito’s staking pool or related programs could lead to financial losses or reward distribution issues for stakers.

- MEV Market Volatility: Reduced MEV opportunities on Solana could lower additional rewards, diminishing the attractiveness of JitoSOL’s yield compared to rivals like Marinade Finance.

- Regulatory Risks: Regulatory scrutiny on liquid staking platforms or governance tokens could lead to compliance challenges or negatively impact Jito’s market perception.

- Developer Dependency: Reliance on the specialized expertise of Jito Labs' core team poses risks if key talent departs or development stalls.

- Layered Complexity: Additional layers like restaking or TipRouter could introduce technical dependencies and risks, potentially impacting reward distribution and system stability.

Final Thoughts

In our view, Jito Network is not standing still: it’s branching into new territories (like restaking), refining Solana’s core operation (with BAM), and actively engaging with the community and other protocols.

We believe Jito has so far demonstrated strong competence. The absence of major incidents and the growing trust (shown by huge stake inflows) suggest the benefits are outweighing risks for many.

If Jito's developments pan out, we could see a future where Solana’s block production and economic security are heavily shaped by technology that Jito pioneered, yet governed and operated by a decentralized community. And we’re heavily rooting for that future to unfold.

Frequently asked questions

Who are Jito Network Founders?

Jito Network was co-founded by Lucas Bruder and Zano Sherwani in September 2021 through their research and development startup, Jito Labs. Bruder, serving as CEO, brings extensive experience in high-frequency trading and Solana development, and is widely known within the ecosystem as "Buffaloo."

Sherwani acts as CTO, leveraging his background in software engineering and crypto systems to guide the project’s technical vision. Together, Bruder and Sherwani spearheaded the development of Jito’s infrastructure, including the specialized Jito-Solana validator client and tools for MEV optimization.

How Does Jito Compare to Other Liquid Staking Platforms?

JitoSOL differs from competitors like Marinade (mSOL) or Lido (stSOL) by uniquely incorporating MEV capture into its staking rewards, resulting in typically higher yields.

While Marinade emphasizes decentralization by delegating stake widely among many smaller validators, Jito prioritizes validator performance and profitability through its MEV-boosted infrastructure.

Is Jito Network Safe and Audited?

Yes, Jito Network has undergone multiple security audits by reputable auditing firms, including Neodyme, OtterSec, and Halborn, to verify its staking pool and smart contract security.

As of mid-2025, Jito has operated reliably without major security incidents, further demonstrated by listings and integrations with major exchanges and institutional-grade products.

What Wallets Are Compatible with Jito Network?

Jito Network supports all popular Solana wallets, including Phantom, Solflare, and Ledger hardware wallets. Users can easily connect these wallets directly to Jito’s staking interface or decentralized exchanges like Jupiter to seamlessly swap SOL for JitoSOL and manage their staked assets.

What Fees Does Jito Network Charge Users?

Jito Network itself does not charge direct staking fees, but validators typically collect a small commission (commonly around 0.3%) on earned rewards. Additionally, when unstaking directly via Jito, there are no extra fees, but swaps through decentralized exchanges might incur slight transaction fees or slippage costs.

Written by

Antony Bianco

Head of Research

Antony Bianco, co-founder of Datawallet, is a DeFi expert and active member of the Ethereum community who assist in zero-knowledge proof research for layer 2's. With a Master’s in Computer Science, he has made significant contributions to the crypto ecosystem, working with various DAOs on-chain.

.webp)