SEC Drops Ripple (XRP) Case With $125 Million Fine

GM. The SEC has dropped its five-year case against Ripple, leaving a $125 million fine and key precedent intact while ending one of crypto’s most-watched legal battles.

Meanwhile, LayerZero proposes a $110 million buyout of the Stargate bridge, El Salvador opens bitcoin custody to investment banks, and Binance teams with BBVA for off-exchange asset storage.

A high-profile legal close and major institutional moves set the tone for the week ahead. 👇

SEC Drops Ripple (XRP) Case With $125 Million Fine

The US Securities and Exchange Commission and Ripple Labs have jointly dropped appeals in their landmark securities case, ending a five-year battle. Filed Thursday in the Second Circuit, the dismissal leaves intact Judge Analisa Torres’ $125 million fine and permanent injunction.

Judge Torres’ July 2023 ruling deemed XRP sales to institutional investors unregistered securities, while clearing retail exchange sales of regulatory violations. Both parties will bear their own legal costs, with Ripple CEO Brad Garlinghouse declaring the matter closed to refocus on product expansion.

The SEC first sued Ripple in December 2020 under then-Chair Jay Clayton, accusing it of illegally raising funds through XRP sales. Ripple’s cross-appeal sought to narrow penalties, but multiple attempts to reduce the fine were rejected by Torres over public-interest concerns.

News of the settlement pushed XRP’s price over 7% higher, reaching $3.27 and briefly adding billions to its market capitalization. The outcome cements a precedent distinguishing institutional token sales from secondary-market trades, now unchallenged by either regulator or defendant.

LayerZero Proposes $110M Purchase of Stargate Bridge

LayerZero Foundation has offered to acquire the Stargate bridge and its STG tokens for about $110 million, aiming to consolidate the product within its ecosystem. The plan would dissolve Stargate’s DAO, discontinue the STG token, and exchange it for LayerZero’s ZRO token at a set ratio. LayerZero CEO Bryan Pellegrino said the deal would speed up Stargate’s roadmap and expand its scope beyond bridging.

Stargate, launched by LayerZero in 2022, has processed over $70 billion in transfers but seen its token fall about 95% from its peak. News of the offer pushed STG and ZRO prices higher, lifting the deal’s value to around $127 million. Some community members argue the terms undervalue Stargate given its revenue potential and prior token highs.

El Salvador Allows Investment Banks to Hold Bitcoin

El Salvador has passed a law enabling large financial institutions to hold bitcoin and offer digital asset services to qualified investors. Banks with at least $50 million in capital can register as investment banks, layer crypto licenses onto existing approvals, and issue or structure bitcoin-linked products. The Ministry of Economy says the move expands the nation’s financial architecture under regulatory oversight.

The change shifts focus from retail to institutional adoption after earlier mandates for merchants to accept bitcoin saw limited uptake. Analysts report low citizen usage, with minimal remittance activity in crypto. The central bank says no new BTC has been bought since an IMF loan deal, despite public claims of daily purchases by the Bitcoin Office.

Binance and BBVA Partner on Off-Exchange Asset Custody

Binance is working with Spanish banking giant BBVA to let clients hold trading collateral off-exchange, according to sources cited by the FT. Funds will be stored in US Treasuries at BBVA, which Binance accepts as margin, reducing counterparty risk similar to practices in traditional finance. The setup follows heightened scrutiny after Binance’s $4 billion US settlement.

BBVA’s involvement adds a recognized financial brand to Binance’s custody options, joining partners like Sygnum and FlowBank. The bank has expanded into bitcoin and ether services and advises clients to allocate a small portion of portfolios to crypto. Other exchanges, including OKX and Deribit, have launched similar off-exchange custody arrangements for institutions.

Data of the Day

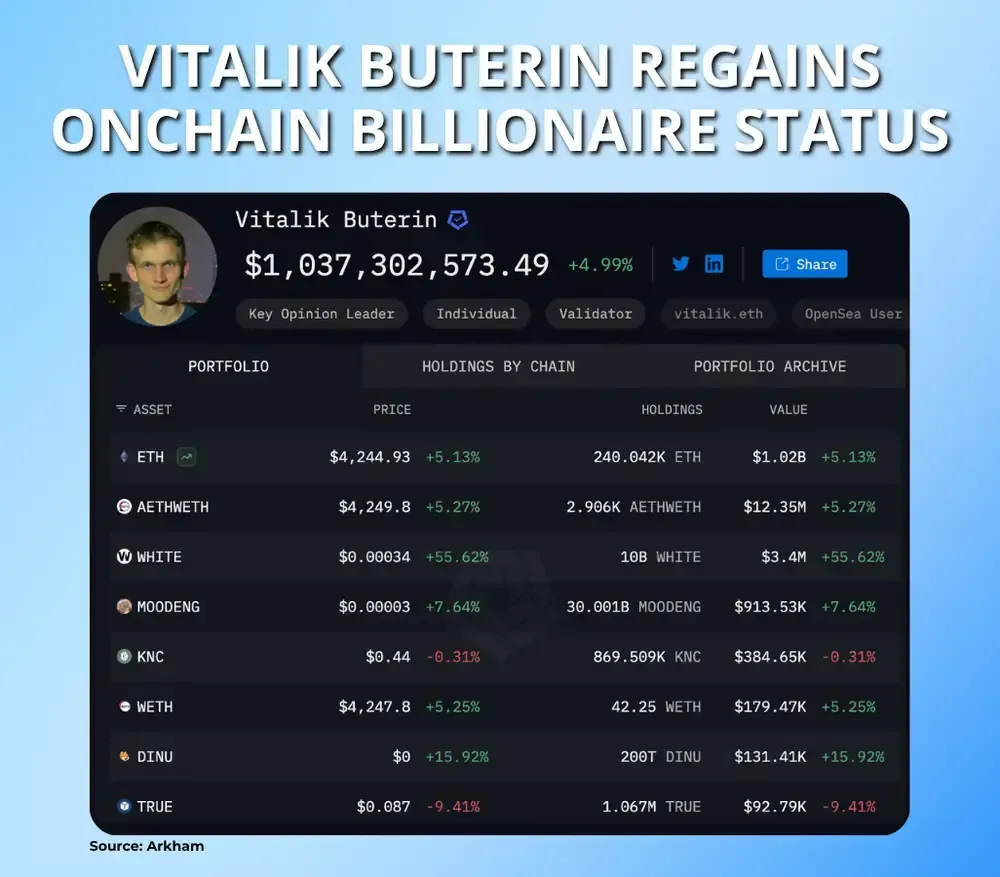

Ethereum co-founder Vitalik Buterin’s crypto holdings have risen above $1 billion as ETH climbed past $4,200. His wallet contains over 240,000 ETH plus smaller positions in various tokens, according to Arkham data. The price surge comes amid strong ETF inflows for Ethereum and speculation about a potential short squeeze if ETH moves toward $4,500.

Traders see momentum building for ETH to retest its $4,878 all-time high, with onchain activity and institutional demand rising. US spot ETH ETFs have attracted more capital than Bitcoin ETFs in recent days, signaling investor interest. Buterin, first a crypto billionaire in 2021, recently cautioned that excessive leverage from ETH treasury strategies could threaten the network’s stability.

More Breaking News

- World Liberty Financial is seeking $1.5 billion from major investors to launch a public crypto holding firm for WLFI tokens as Trump champions pro-crypto policies.

- Coinbase will introduce decentralized exchange trading in its app starting with Base assets, with Solana support coming soon, expanding its push to become an “everything exchange.”

- The original pink beanie from the Dogwifhat meme sold for 6.8 BTC to Bags’ founder, far below the $4.3 million NFT photo sale.

- Harvard revealed a $116 million investment in BlackRock’s Bitcoin ETF, joining Brown University and other institutions gaining regulated exposure to the leading cryptocurrency.

- CrediX Finance vanished from all platforms after a $4.5 million exploit, sparking suspicions of an exit scam despite earlier promises to reimburse users.

- PumpFun launched the Glass Full Foundation to inject liquidity into select memecoins as platform revenue declines and rival LetsBonk gains market share.

- BitMEX co-founder Arthur Hayes repurchased $10.5 million in ETH at higher prices a week after selling, joking he will “never take profit again.”

For the latest updates on digital asset markets, follow us on X @Datawalletcom.

.webp)

Written by

Jed Barker

Editor-in-Chief

Jed, a digital asset analyst since 2015, founded Datawallet to simplify crypto and decentralized finance. His background includes research roles in leading publications and a venture firm, reflecting his commitment to making complex financial concepts accessible.