What is Raydium (RAY)?

Summary: Raydium is a decentralized exchange (DEX) and automated market maker (AMM) built on the Solana blockchain. It leverages Solana’s high-speed and low-cost transactions to offer smooth trading, liquidity provision, and yield farming opportunities.

Raydium also serves as a key infrastructure piece in the Solana ecosystem, providing liquidity to decentralized finance (DeFi) applications and supporting the growth of new projects.

What is Raydium?

Raydium is an advanced decentralized exchange (DEX) and automated market maker (AMM) built on the Solana blockchain, known for its lightning-fast transactions and minimal fees. As the first hybrid AMM, Raydium combines the liquidity of its own pools with Solana’s central limit order books, offering a unique trading experience.

Users can easily interact with Raydium using a Solana Program Library (SPL) wallet, such as Phantom or Solflare, which is required to store funds and execute transactions on the platform. Metamask users can use Solana Snaps to connect to the exchange.

Raydium’s mobile optimization ensures a seamless experience for both token swaps and liquidity management on the go. The platform’s features, such as permissionless pool creation and ecosystem rewards, make it a versatile tool for both casual users and experienced DeFi traders.

How Does Raydium Work?

Raydium operates as a hybrid AMM that connects directly to the central limit order book on the Solana blockchain, enabling seamless trading and liquidity provision.

- Swapping: Traders can swap tokens quickly and cost-effectively within Raydium’s liquidity pools, taking advantage of Solana's fast transaction speeds.

- Providing Liquidity: LPs can provide liquidity to pools and earn fees from trades that occur within those pools.

- Creating Pools: Individuals and projects can create new liquidity pools, including concentrated liquidity (CLMM) pools and permissionless AMM pools, allowing for tailored market-making and liquidity strategies.

- Yield Farming: Users can participate in ecosystem farms, earning additional rewards by providing liquidity to specific pairs or pools (be careful for impermanent loss).

- Token Launches: Raydium’s AcceleRaytor platform allows new projects to launch tokens and establish initial liquidity through decentralized offerings.

Users can track their Raydium portfolio at any time to view a breakdown of assets, pools, and farms.

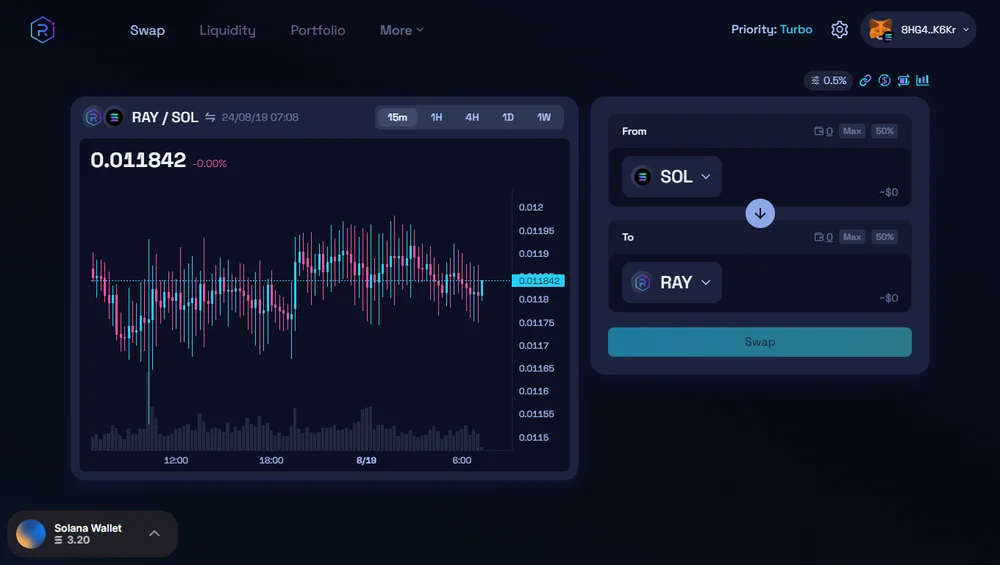

Raydium Swap

Swapping tokens on the Raydium exchange is a fast and cost-effective way to trade assets on the Solana blockchain. To swap, users navigate to the Swap section, connect their wallet, select tokens, and confirm the transaction. After choosing the amount and confirming the transaction, the new balance is reflected in their wallet almost instantly.

Raydium's user-friendly interface and robust infrastructure make it a top choice for efficient token swaps. Currently, Raydium's weekly swap volume stands at around $2.1 billion, placing it among the top decentralized exchanges.

Providing Liquidity on Raydium

Providing liquidity on Raydium allows users to earn fees by supplying tokens to the platform's liquidity pools. To get started, users select the Liquidity option from the navigation menu, connect their wallet, and choose a pool to deposit their tokens. They then specify a price range and deposit amounts, creating a liquidity position that is represented by an NFT in their wallet.

This process maintains liquidity and rewards providers with a share of trading fees. Raydium currently has a total value locked (TVL) of $1 billion, making it the fourth-largest decentralized exchange by TVL.

If you encounter issues with adding liquidity on Raydium, ensure your wallet is connected, has sufficient SOL for transaction fees, and that you are adhering to the required token ratios. Typically, it's recommended to keep at least 0.05 SOL in your wallet to ensure successful transactions. If problems persist, check Raydium’s support documentation or community channels for assistance.

Creating Raydium Pools

Raydium offers three types of liquidity pools for different needs:

- CLMM Pool: Advanced market-making with concentrated liquidity, higher capital efficiency, and reduced slippage.

- OpenBook AMM Pool: Permissionless pools that allow instant trading on Raydium after setting the market ID, starting price, and initial liquidity.

- Ecosystem Farm: Incentivizes liquidity by linking a farm to an AMM ID and rewarding liquidity providers with token emissions.

These options offer flexible liquidity management solutions, supporting over 4,827 market pairs.

Raydium Fees

Raydium charges small trading fees on swaps, which are distributed to incentivize liquidity providers, fund RAY buybacks, and support the protocol's treasury.

- Standard AMM pools: Trading fee is 0.25%; 84% to LPs, 12% to RAY buybacks, 4% to treasury.

- CP-Swap pools: Trading fee tiers of 4%, 2%, 1%, or 0.25%; 84% to LPs, 12% to RAY buybacks, 4% to treasury.

- CLMM pools: Trading fee tiers from 2% to 0.01%; 84% to LPs, 12% to RAY buybacks, 4% to treasury.

- Pool creation fees: 0.4 SOL for standard AMM pools, 0.15 SOL for CP-swap pools, supporting protocol sustainability.

RAY Tokenomics

RAY is Raydium's native utility token, central to staking, buyback programs, and overall ecosystem operations. Key aspects of RAY tokenomics include:

- Total Supply: 555 million RAY.

- Mining Reserve: 34% (188.7 million RAY) allocated to mining incentives.

- Buybacks: 12% of trading fees are used to buy back RAY.

- Team & Ecosystem: 30% for partnership and ecosystem development, and 20% for the team, with vesting periods.

So far, Raydium has conducted only one token airdrop, way back in 2021, and hasn't mentioned plans to do another one. The Raydium Airdrop campaign concluded with $100,000 in RAY distributed to winning wallets.

Raydium AcceleRaytor

Raydium’s AcceleRaytor serves as a launchpad for new projects on the Solana blockchain, helping them raise capital and establish initial liquidity. It allows both project teams and the Raydium community to participate in curated token offerings.

Participants can contribute funds to specific pools in exchange for new tokens, following a lottery model where allocations are determined. This initiative backs emerging projects and strengthens Raydium’s ecosystem by stimulating innovation at the earliest stages.

Pump.fun and Raydium Partnership

The partnership between Raydium and Pump.fun has been mutually beneficial, enhancing both platforms' reach and utility. Pump.fun, known for its innovative token creation platform, uses Raydium to add liquidity to its tokens once they reach a market cap of $69,000.

This integration with Raydium's liquidity pools ensures stability and trust in the trading of these tokens, while Raydium benefits from the increased transaction volume and liquidity provided by Pump.fun's active community.

Since the beginning of 2024, the total amount of new tokens on DEXs has increased from 17,000 weekly to 140,000, with over 100,000 coming from Solana.

Bottom Line

Raydium is a versatile and powerful platform in the Solana ecosystem, offering users a wide range of DeFi tools, from token swaps to liquidity provision and project launches. By leveraging the speed and low cost of the Solana blockchain, Raydium has become a go-to solution for both casual users and developers.

Raydium and Pump.fun have played pivotal roles in the recent growth of tokens on Solana, making them highly influential and sometimes controversial in the crypto space.

While more sophisticated users believe that Solana meme coins are harmful to the industry as a whole, it is undeniable that retail crypto adoption has been stagnant for some time prior to the recent boom in Rayidum tokens. Overall, the project will stick out as one of the most used protocols in 2023-2024.

.webp)

Written by

Jed Barker

Editor-in-Chief

Jed, a digital asset analyst since 2015, founded Datawallet to simplify crypto and decentralized finance. His background includes research roles in leading publications and a venture firm, reflecting his commitment to making complex financial concepts accessible.

.webp)

%2520(1).webp)

%25201%2520(1).webp)